Because of this insurance, CDs are relatively low-risk investments. While six-month Treasurys were recently yielding 5.5%, the best six-month CDs slightly exceed that amount. Meanwhile, the top-yielding money-market mutual funds yielded between 5.1% and 5.2%. While being picky can pay off by fractions of a percentage point, the big picture is that there are now multiple ways to keep your cash a step ahead of the 3.7% inflation rate. Until this year, interest rates had generally trailed inflation, meaning your safely invested cash was continually losing buying power. “Real rates, which are rates after you’ve adjusted for inflation, are the highest we’ve seen in a very long time,” says Gunster.

First Horizon Bank CD Rates for November 2024

Some banks and credit unions offer no-penalty CDs, which allow you to make penalty-free withdrawals. Whether a CD, savings or money market account, the right type of account for you depends on your savings needs and goals. Some accounts offer more access to your money, while others offer higher interest.

Vio Bank

For example, an S&P 500 index fund follows the S&P 500 index, which has 500 of the largest publicly traded U.S. companies. The S&P 500 has an average long-term return of about 10% per year, so index funds that track it are a popular choice with investors. Thanks to high interest rates, certificates of deposit (CDs) have been a popular investment this year. That’s a solid return, especially if you’re looking for a secure investment that won’t lose money.

CDs vs Money Market Accounts: Which Is Better for You?

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. If you’re risk-averse and prefer knowing exactly what your return will be, a CD may be your preferred choice. If you’re willing to take on a little more risk for potentially higher returns, an MMA might be the right choice. The interest is typically compounded daily or monthly and paid out monthly. However, there may be restrictions on the number of transactions you can make each month.

Compare the rates and terms of the best money market accounts to those of the best high-yield savings accounts to find the right place to grow your money. Although MMAs may offer easier invest in cds or money market access to your funds, you may find a savings account with a great rate and agreeable terms. Basically, they can be thought of as a blend of traditional checking and savings accounts.

CDs are often used to fund goals within a 10-year time frame, when you may not want to risk the price fluctuation of market-based options, such as a stock mutual fund. With traditional CDs, banks charge a penalty for withdrawing money prior to the maturity date. Some banks now offer no-penalty CDs that allow you to withdraw your money without that penalty, but you are likely to receive a much lower interest rate for that privilege. Other types of CDs allow you to withdraw only interest without penalty. The interest rates on MMAs are variable, which means they rise and fall with the overall interest rate market. Most MMAs come with limited check-writing and balance-transfer privileges.

They also provide higher interest rates than a standard savings account, but usually have lower rates than CDs. So if you have savings that you want to continue using, but you’re not happy with the current bank interest rate you’re getting, a money market account could be a great option. Both money markets and CDs are low-risk savings options, as they both carry FDIC insurance. But CDs also minimize other types of risk, like sudden drops in interest rates, by offering fixed terms . MMAs may also be a better choice in an environment of rising interest rates.

- Money market accounts typically come with a debit card and/or checkbook, making it easier to access your funds should the need arise.

- It ensures you have ready access to your money in case of emergencies.

- The biggest difference between the two is that a money market account is more likely to give you features you typically find with a checking account, like debit card access.

- So if you were to deposit $1,000 into a savings account at that rate and leave it there for one year—without making any new contributions—you’d earn $4.60 in interest.

- With the No Penalty CD, withdraw all your money any time after the first 6 days following the date you funded the account and keep the interest earned with no penalty.

This funding will help us continue to expand and provide more homes in more locations, supporting company growth. This shareholder offering supports our expansion into new destinations and strengthens our product, engineering and home operations. The investment opportunity aligns with our mission to democratize real estate enabling more people to invest in our growth and get equity in Pacaso. The purchase process was very streamlined, it was the most painless financing I’ve ever been a part of in a real estate transaction.

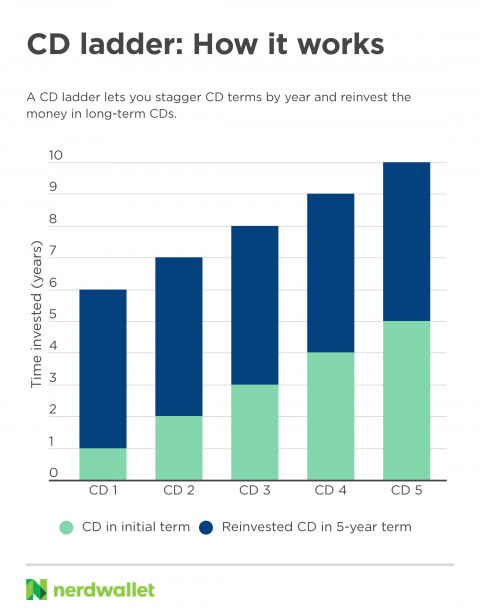

Many banks will roll your savings and interest over to a new CD term automatically if you don’t specify that you’d like to withdraw your savings. Having multiple CD options to choose from can be a good thing if you’re interested in building a CD ladder. The idea is that by having multiple CDs maturing at different times, you gain more liquidity and have more opportunities to access savings when one of them matures. Depending on the CD, this could be anywhere from 30 days to five years.